For almost twenty years WIN had enjoyed a fruitful relationship with Nine as its affiliate in regional markets in New South Wales (including the Australian Capital Territory), Victoria, Tasmania, Queensland, Western Australia and South Australia with a schedule dominated by Nine Network product.

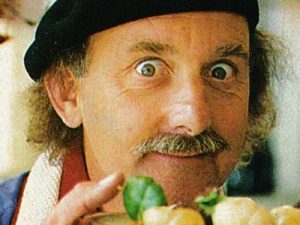

This year saw that somewhat cosy relationship almost fall to pieces as the affiliation agreement which gave WIN access to Nine’s program supply was up for renewal. WIN owner Bruce Gordon (pictured) had been mates with Nine’s owner Kerry Packer – but now with Packer passed away, and Nine no longer controlled by the Packer family, with a new management structure in place and a majority now owned by private equity firm CVC Asia-Pacific, it was now a different playing field.

This year saw that somewhat cosy relationship almost fall to pieces as the affiliation agreement which gave WIN access to Nine’s program supply was up for renewal. WIN owner Bruce Gordon (pictured) had been mates with Nine’s owner Kerry Packer – but now with Packer passed away, and Nine no longer controlled by the Packer family, with a new management structure in place and a majority now owned by private equity firm CVC Asia-Pacific, it was now a different playing field.

Nine made it clear to Gordon that they now wanted to increase the premium that WIN already paid for the rights to Nine’s programs in its regional markets. The previous agreement between Nine and WIN had the regional network paying around 32% of all revenue to Nine in return for its program feed – a higher rate than WIN’s competitors were paying other networks Seven and Ten, but Gordon agreed as Nine was the top rating network and so therefore allowed WIN to also charge a premium to advertisers as its ratings would have followed Nine’s trend.

The new deal reportedly put forward by Nine was for WIN to pay 50% of all revenue for access to Nine’s programs, and also to lock WIN into a long-term deal up to ten years. Gordon felt such an increase was not justified in the wake of Nine’s lowered ratings performance which saw the network beaten this year by arch rival Seven, and also did not want to agree to such a costly deal for a lengthy ten-year term.

The negotiations between Nine and WIN appeared to make little progress – Nine wasn’t prepared to budge from its original offer, and Gordon wasn’t prepared to meet Nine on its terms. The process became very public as Gordon was happy to talk to the press about what he felt was an unjustified rate increase by Nine. Gordon also publicly questioned some of Nine’s programming decisions which, under the affiliation deal, WIN is normally obliged to emulate.

As the existing agreement lapsed, the situation turned nasty as WIN started pulling Nine programs off its schedule and replacing with programs it had sourced itself. Gordon is well established in international TV circles, having worked for many years as an execute with Paramount Television, and made the claim that WIN did not need Nine’s program supply to be sustainable, and could instead source its own programs independently – creating an unprecedented move to establishing a competitive independent regional network not to be fed programs from one of the capital city networks.

Separate to the affiliation negotiations, WIN was also in battle against Nine’s owner PBL Media as both were vying for control of the Nine Network’s affiliate stations in Perth and Adelaide – which were owned by Sunraysia Television and Southern Cross Broadcasting respectively. Sunraysia had accepted an offer by PBL Media to buy its STW9 Perth, which was less than a similar bid that WIN had already made – highlighting a long-running feud between Gordon and Sunraysia chief Eva Presser. WIN then took legal action against PBL’s offer, and eventually won control of STW9 for $163 million. The battle for control of NWS9 Adelaide was less frantic, as WIN bought the station for $105 million.

WIN also fought Nine for control over Northern NSW regional broadcaster NBN – representing a market of around 2 million viewers, making it comparable in size to a number of capital cities. The battle for NBN was not won by WIN, as PBL Media gained control for around $250 million.

With WIN now owning Nine’s affiliates in Perth and Adelaide, this gave them a stronger negotiation position in forcing Nine to review its affiliation demands – although NWS9’s program supply from Nine was assured as it had already entered into a renewed deal by its previous owners – because if WIN pulled out of the Nine program feed to its regional markets as well as Perth, that would severely impact Nine’s direct revenue as WIN’s affiliation potentially contributes as much as 30 per cent of Nine’s revenue. And the addition of the Perth and Adelaide markets to its portfolio meant WIN now had extra buying power in negotiating its own program supply deals away from Nine.

But Gordon’s ambition to program WIN independently from Nine was not a flawless proposition. Despite Gordon’s industry connections, it would be a challenge to be able to program WIN with a 24-hour schedule that would be competitive against the network-sourced offerings of its rivals. WIN would also have to source, fund or produce a required quota of Australian program content – with individual quotas also applied to first-run children’s and drama programming. Being of largely regional operations, WIN would have lacked the necessary infrastructure, at least in the short term, to support such levels of local production

An independently-programmed WIN would also hit walls in negotiating supply deals with the major US distributors as most of them are locked into exclusive deals with the Australian Seven, Nine and Ten networks – possibly preventing WIN entering into its own contracts.

Basically, WIN needs Nine as much as Nine needs WIN.

Gordon’s next play in the negotiations was to go through – to a small but significant extent – with his threat to withdraw from the Nine partnership. WIN had managed to switch its South Australian outlets (SES8 Mt Gambier and RTS5A Riverland) from a Nine Network format, to a Seven Network affiliation – effectively taking Nine’s programming out of the reach of viewers in those markets as the only other local commercial TV outlet there is a Network Ten relay, also operated by WIN. The total number of viewers this represents is small in comparison to WIN’s other markets but its entering into a deal with Seven showed that Gordon was willing to explore other options to Nine in sourcing programs

The deal between WIN and Seven proved to be the final straw in negotiations, as barely days later, WIN and Nine announced they had reached an agreement for its other regional markets, and for STW9 Perth, which would reportedly see WIN paying 35 per cent of all revenue for Nine’s program feed over a five-year period.